Does the city of Oakland have a real estate transfer tax?

The answer is YES.

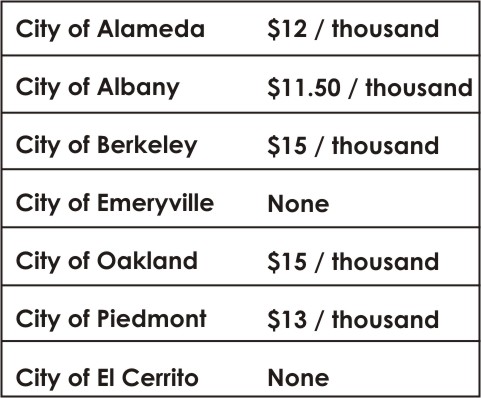

It is equal to 1.5% of the sale price. ($15/ thousand of sale price) In a typical real estate transaction it is customary for the Seller to pay 50% and the Buyer to pay 50%. The county of Alameda imposes a transfer tax of $1.10 per thousand and is customarily paid by the Seller. For more information about the Oakland, Piedmont or Berkeley real estate market please contact Brian directly

[1]

.

Brian Santilena is a Realtor and CRS (Certified Residential Specialist) with Pacific Union International Real Estate. He has been selling homes in Oakland [2] , Piedmont [3] and Berkeley [4] California since 1998. He is a licensed California contractor and local real estate expert.